NCERT Solutions for Class 12 Accountancy Part 1 Chapter 5 for 202324

June 20, 2022. T.S Grewal Solutions (12) 7. Share your love. Are You looking for the solutions of chapter 5 Admission of Partner of TS Grewal Book Class 12 Accountancy Book 2021-22 Edition? I have solved each and every question of the 5th chapter of TS Grewal Book of latest 2021-22 Editon. The link to All unsolved questions has been given below.

Adjustment of Capital Admission of a Partner Chapter 5 Class 12 Accountancy YouTube

NCERT Solutions for Class 12 Accountancy Chapter 5 - Dissolution of Partnership Firm furnishes us with all-inclusive data on all the concepts. As the students would have learnt the fundamentals of the subject of accountancy in Class 11, the NCERT Class 12 Solutions is a continuation of it. You can access the free PDF of the solutions from the.

Account Class12 Solutions (Dk APK for Android Download

Accounting Courses to Suit Your Career Goals with 3 Routes to Qualify at BPP. Lear More. Work Towards a Successful Career in Accountancy. With a Wide Range of Accountancy Courses.

Account Class12 Solutions (TS Grewal Vol1) 2019 for Android APK Download

Class 12 Accountancy students should read the following DK Goel Solutions for Class 12 Chapter 5 Accounting Ratios in Standard 12. All solutions provided below can be downloaded in Pdf and are available for free. This DK Goel Book for Grade 12 Accountancy will be very useful for exams and help you to score good marks in Class 12 accountancy.

RBSE Solutions for Class 12 Accountancy Chapter 5 कम्पनी लेखे अंशों एवं ऋणपत्रों का निर्गमन

Highlights of NCERT Solutions for Class 12 Accountancy Chapter 5 - Accounting Ratios. Know a few basic details about the NCERT Solutions presented below before you start using them for preparation.

RBSE Solutions for Class 12 Accountancy Chapter 5 Company Accounts Issue of Shares and

NCERT Solutions for Class 12 Accountancy provides a wide range of concepts and advanced information regarding the subject, which includes all the questions provided in the NCERT books. Students who aspire to score full marks are advised to use the NCERT Solutions from BYJU'S. NCERT Solutions for Class 12 Accountancy, chapter-wise, are given.

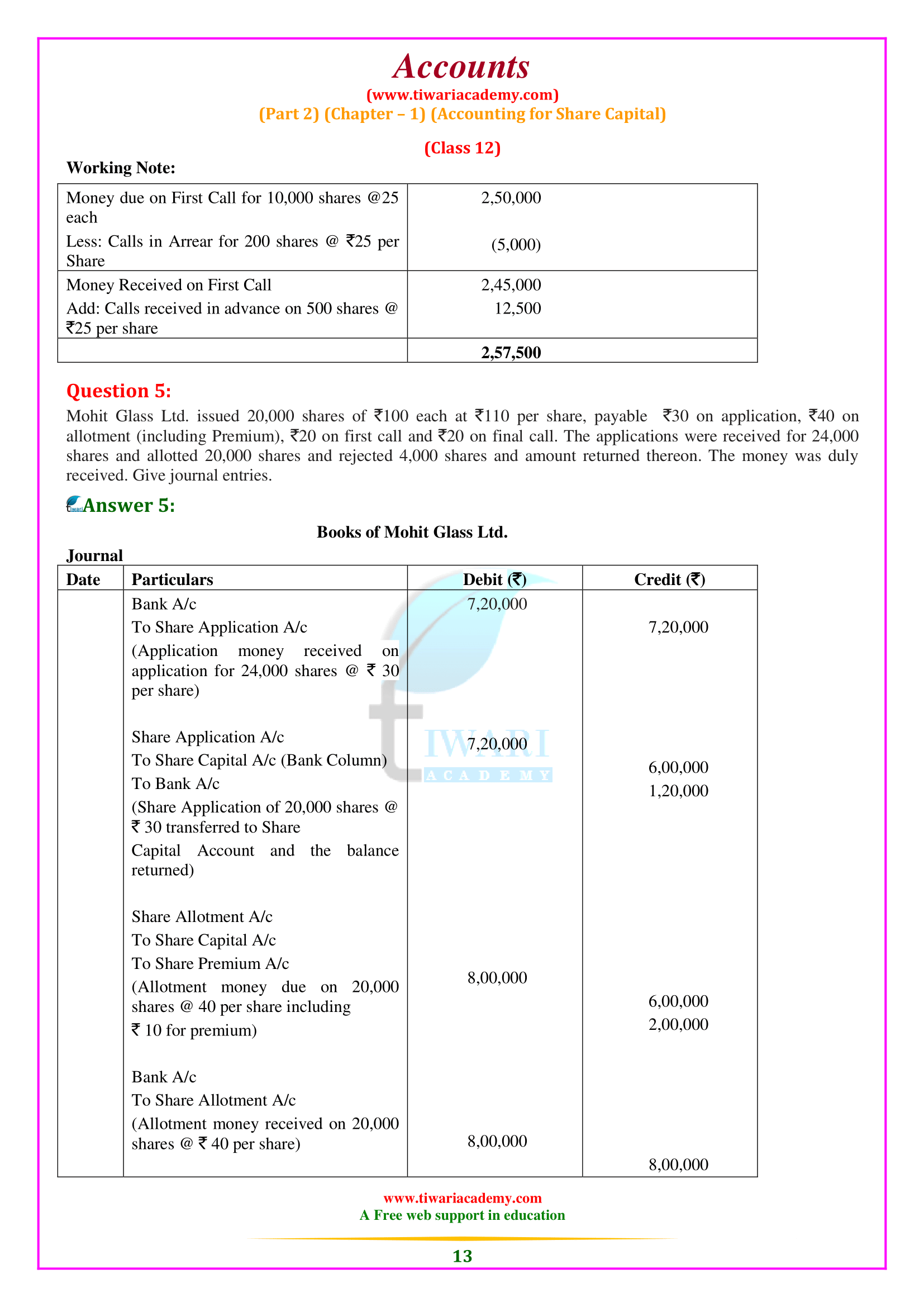

NCERT Solutions for Class 12 Accountancy Part 2 Chapter 1 (Updated)

Get free NCERT Solutions for Class 12 Accountancy - Company Accounts and Analysis of Financial Statements Chapter 5 Accounting Ratios solved by experts. Available here are Chapter 5 - Accounting Ratios Exercises Questions with Solutions and detail explanation for your practice before the examination

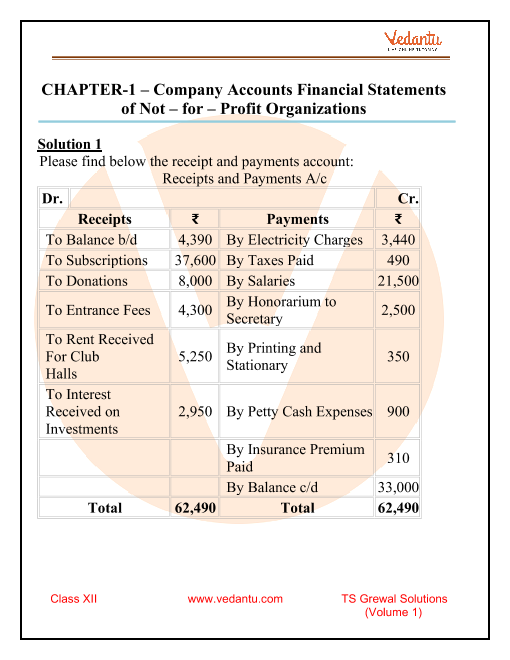

Click here to check out the Solution of Class 12 Accountancy Volume 1 Chapter 1 from TS Grewal

This NCERT Solutions for Class 12 Accountancy contains answers of all questions asked in Chapter 5 in textbook, Accountancy II (Company Accounts and Analysis of Financial Statements). Therefore you can refer it to solve Accounting Ratios exercise questions and learn more about the topic.

Download DK Goel Accountancy Class 12 Solutions Vol 2 Chapter 5 Accounting Ratios PDF

Solution: For, 2017-18. Q.12 From the following information calculate the Inventory Turnover Ratio Revenue from operations ₹6,00,000; Gross profit 25% on cost; Opening inventory was 1/3rd of closing inventory; Closing Inventory was 30% of revenue from operation. Solution: Revenue from operation=6,00,00.

CLASS12 Accounts video23 CH2 Fundamentals of partnership YouTube

TS Grewal offers the 3 volumes of the Accountancy Book of Class 12. Volume - 1 of TS Grewal book class 12 Accountancy consists of two units. Not for Profit Organizations. Partnership. Partnership Units are further divided into the following chapters. Accounting of Partnership Firms - Fundamentals. Goodwill.

chapter 5 design of goods and services solutions vanslimitededition2018

NCERT solutions Class 12 Accountancy Part 2 Chapter 5 deals with users of a financial ratio, current and liquidity ratio, solvency position of the firm, important profitability ratios, managers, investors, long term creditors, solving balance sheets, proprietary ratio, and much more related to company accounts.

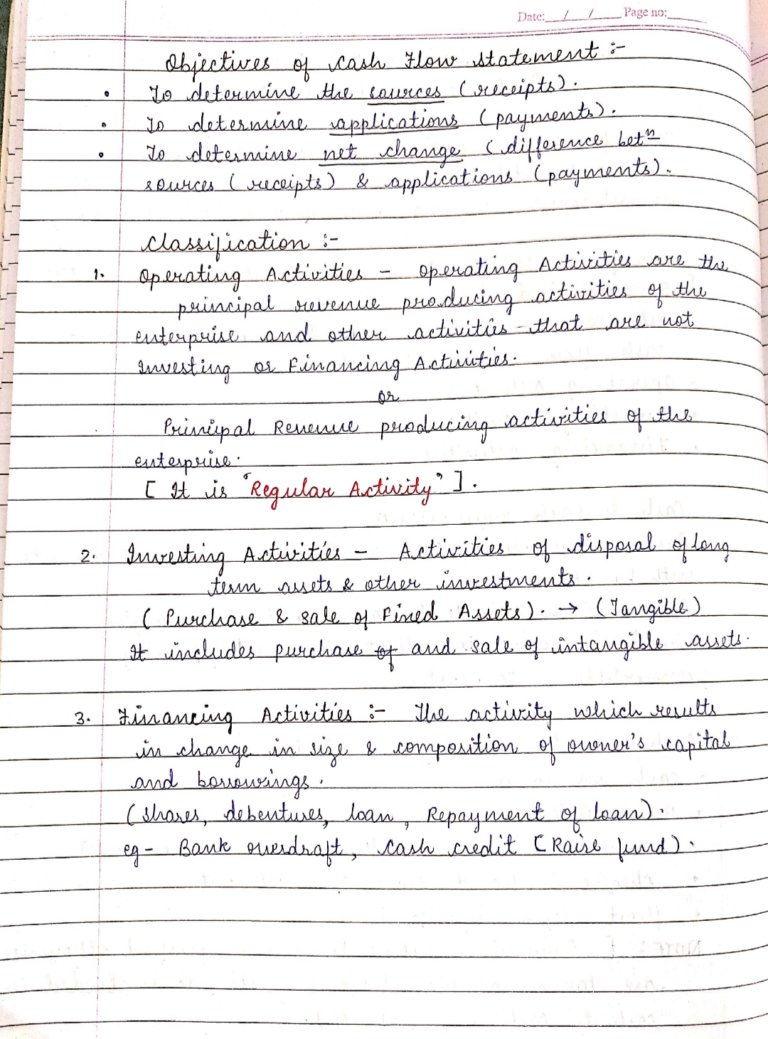

Class 12 Accountancy Chapter 5 Cash Flow Handwritten Notes PDF by Prachi Shankar

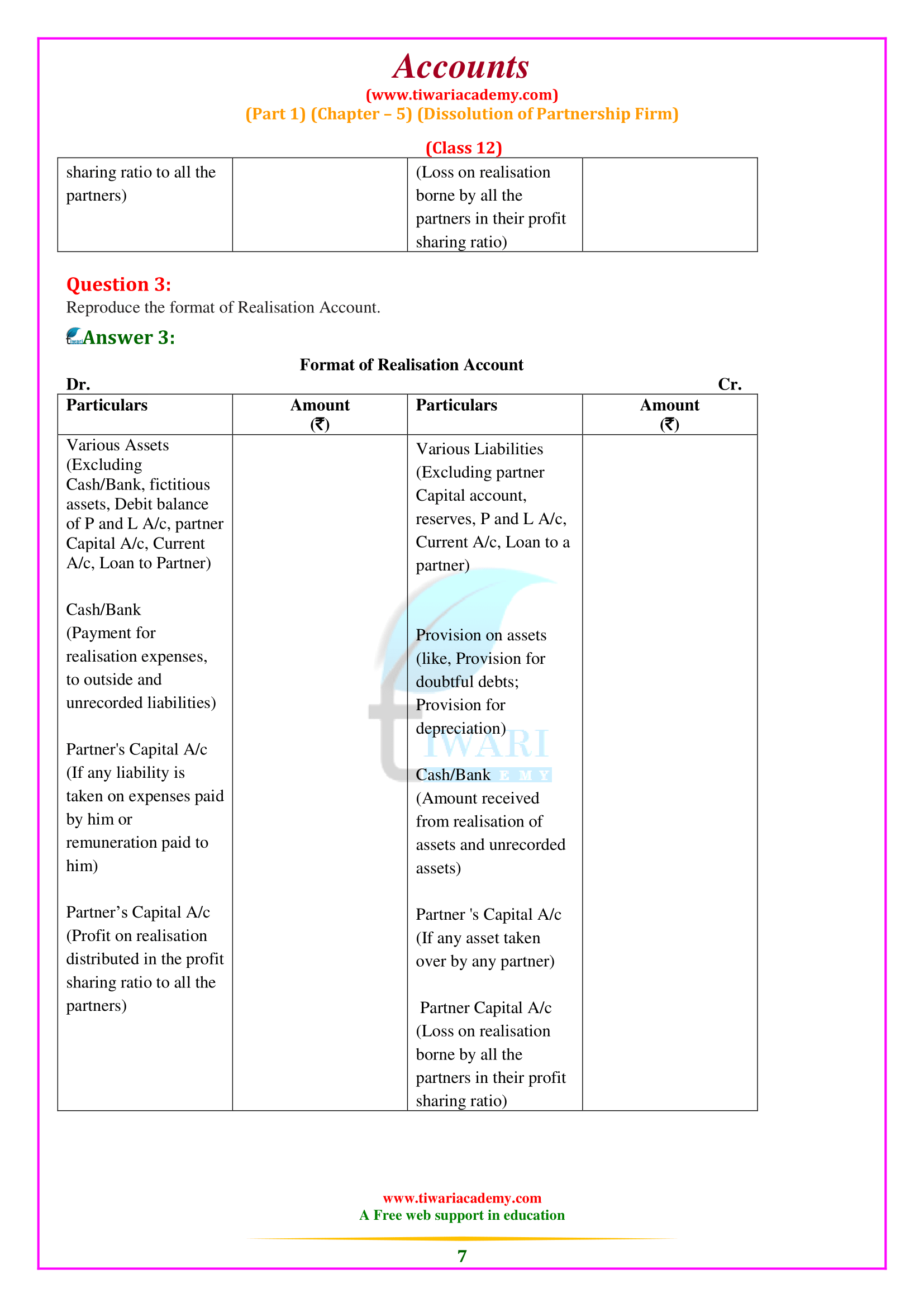

on January 27, 2022, 10:00 AM. NCERT Solutions for Class 12 Accountancy Chapter 5 (Part 1) Dissolution of Partnership Firm. Students can get here the answers of all questions given at the end exercises of NCERT Textbook for accounts academic session 2023-24. Class 12 Accounts chapter 5 extra questions with answers and solutions are given for.

Cbse Sample Paper Class 12 Accountancy 201819 exampless papers

Question 2. A partnership is dissolved when there is a death of a partner. Answer True. As a new partnership deed is to be made. Question 3. A firm is dissolved when all partners give consent to it. Answer True. As all partners agree to it. Question 4: A firm is compulsorily dissolved when a partner decide to retire.

NCERT Solution For Class 12 Accountancy Chapter 5 Dissolution Of Partnership Firm Download Free PDF

Question 5. Current liabilities of a company are Rs. 75,000. If Current ratio is 4 : 1 and liquid ratio is 1:1, calculate value of current assets, liquid assets and stock. Question 6. Handa Limited has stock of Rs. 20,000. Total liquid assets are Rs. 1,00,000 and quick ratio is 2:1 Calculate current ratio. Question 7.

NCERT Solution For Class 12 Accountancy Chapter 5 Dissolution Of Partnership Firm Download Free PDF

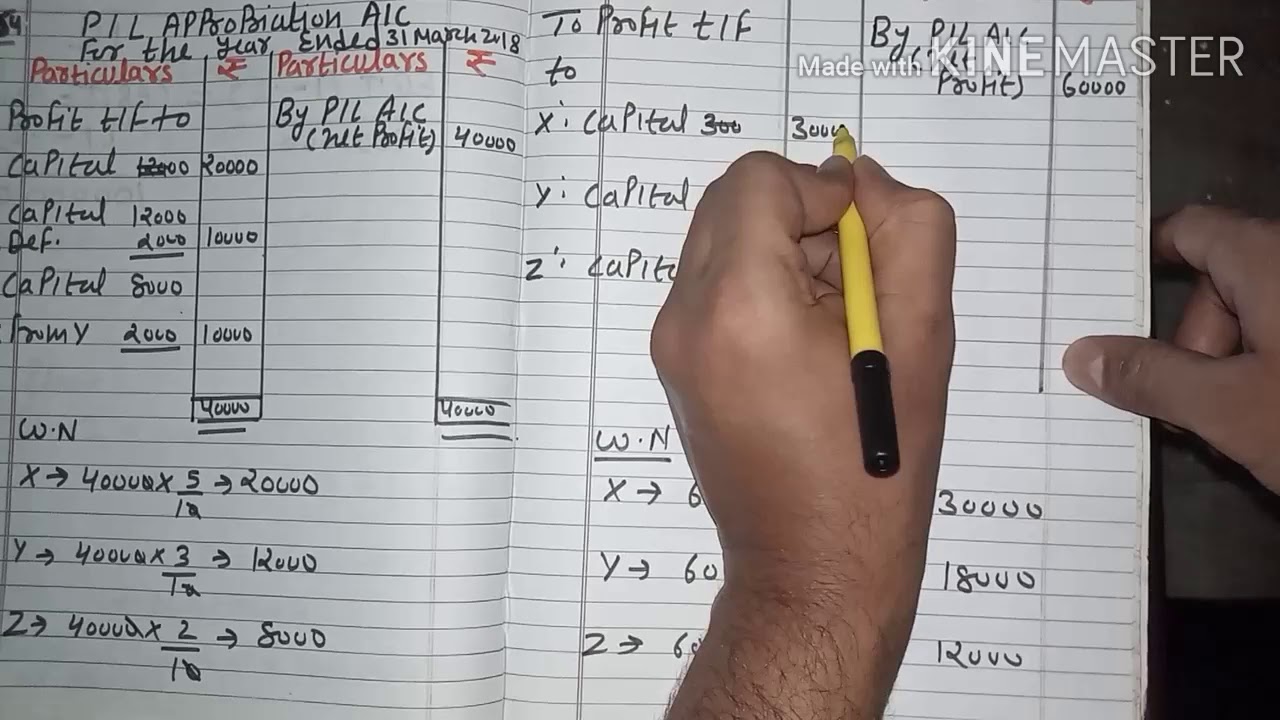

TS Grewal Solutions for Class 12 Accountancy Chapter 5 - Admission of a partner. Question 1. X, Y, and Z are partners sharing profits and losses in the ratio of 5 : 3: 2. They admit A into partnership and give him 1/5th share of profits. Find the new profit-sharing ratio. Solution:

Account Class12 Solutions (TS APK for Android Download

Accounting NCERT Solutions for Class 12 Accountancy Chapter 5 - Ratios d. Working Capital Turnover Ratio: The working capital turnover ratio is used to measure the efficiency of a company in using its working capital to support sales. It is a ratio based on which a firm's operations are funded, and the corresponding revenue generated from the